Best Indian Bank To Open Nre Account

These incomes include rent dividend pension interest etc.

Best indian bank to open nre account. An nre account is a bank account opened in india in the name of an nri to park his foreign earnings. Accounts can be in the form of savings current or term deposit. Features of nre deposits the account. Accounts can be opened jointly with any other non resident indian residents who are close relatives as defined in section 6 of the companies act 1956 of the nri.

Accounts can be opened by remittances from abroad deposit of foreign exchange brought into india transfer from existing self nre fcnr accounts. Whereas an nro account is a bank account opened in india in the name of an nri to manage the income earned by him in india. Nre account interest accumulated on the balance is tax free minimum monthly balance of rs 1000 both principal and interest are fully repatriable tax free interest rate is 4 per annum and is calculated on a daily basis. The bank offers 5 5 on daily balances upto rs.

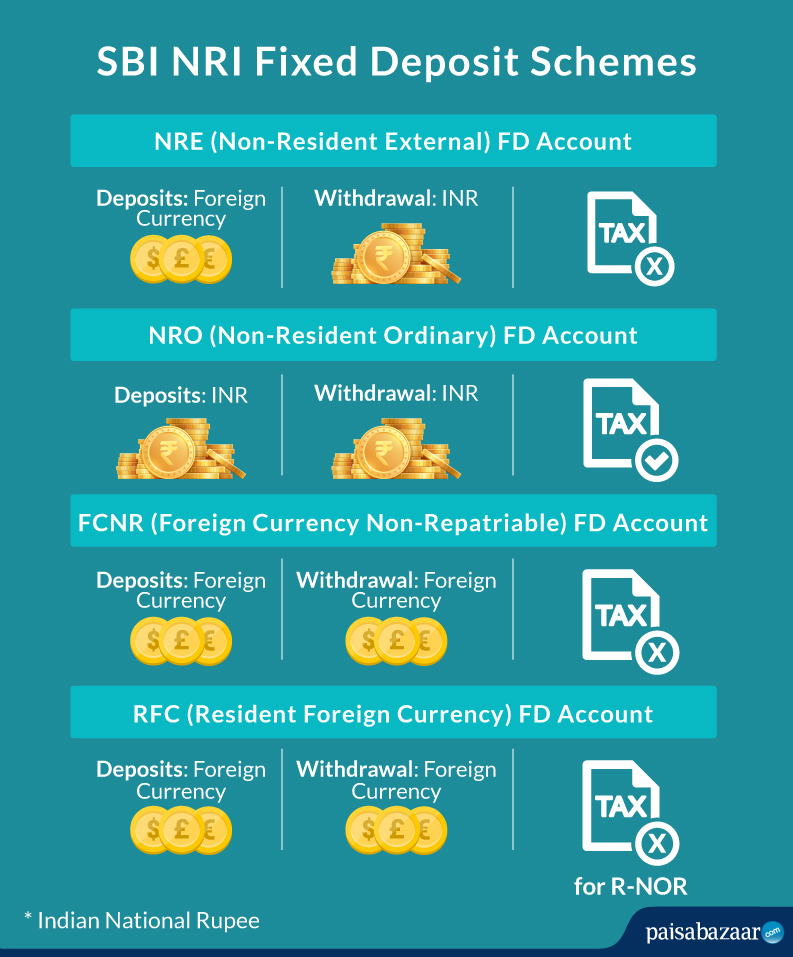

Banks in india provides an option for nris to open and operate either non resident rupee nre account and or a non resident ordinary rupee nro account. The state bank of india offers the following types of nri accounts. Payment as well remittance from abroad to any bank. Nre accounts are exempt from tax.

Joint accounts are permitted. Ratnakar bank nre account is one of the best in terms of interest payment in savings accounts of this category. This nre account is most recommended because of the rate of interest offered. Recently i was doing some research to open an nri savings account in india and given their is so many banks both public and private sector are providing nri services i thought to do some quick checks on the best nri savings account i can get this moment one of my friends suggested me to open your nri savings account in hdfc bank other suggested that he has an account in kotak mahindra and.

1 lakh 6 on daily balances from rs 1 lakh to rs 10 lakhs and 6 5 for daily balances from rs 10 lakhs to. Benefits the investment term for nre account is a minimum of 1 year and a maximum of 10 years incase of an nro account you get minimum period of 7 days and a maximum of 10 years. An nre account is an account maintained by a non resident indian where payments are credited only from outside india by way of drafts or rtgs. Withdrawals however can be made outside india or.

Account can be opened by direct remittance from abroad transfer from existing nre fcnr b accounts or with foreign currency note travellers cheque tendered personally by nris during their visit to india.