Banks That Handle Million Dollar Accounts

Within deposit accounts there are two basic ownership cate.

Banks that handle million dollar accounts. There are a number of things to consider before depositing 1 million into the bank such as what kind of account to put the money in and possible tax consequences of investing the money. The type of deposit dictates the amount of time the bank will delay the availability of funds. For most of us the deposit account is the most common. Some banks will work with as little as 1 million while others require at least 3 million.

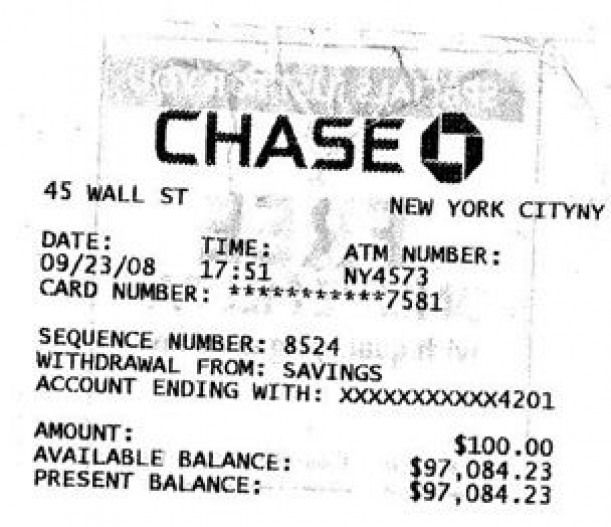

The euromoney survey also named this private bank the best for mega high net worth clients those with more than 250 million in assets and ultra high net worth clients those with more than 30 million but no more than 250 million in assets as well as the best for family office services investment management philanthropic advice and data management and security. I noticed there s a limit in the amount you can have in your regular checking account. If you deposit a check for 1 million your bank must make 100 available on the next business day and a further 4 900 available after two business days the bank can holding the remaining funds for seven business days if you open a new account with the money then the bank can hold the whole check except for the first. Cdars the certificate of deposit account registry service is the most convenient way to access fdic insurance on multi million dollar cd deposits and to earn cd level rates which often compare favorably to treasuries and money market mutual funds.

The union bank private advantage checking account is available to clients who maintain a combined minimum monthly balance of 250 000 in their checking savings investment or retirement accounts. Investable assets include cash investments including brokerage and retirement accounts and some other. Actually fdic insures 250 000 per depositor per ownership category per fdic insured bank. This is how you can gain fdic coverage for up to 50 million instead of managing accounts at 200 separate banks.

I am sure there s a lot of people that has 1 million dollars in their bank because 1 million dollar is not a. Federal law limits the amount of time that a bank can hold a check deposit. Savings money market checking or cd. Access multi million dollar fdic insurance and rest assured.

Certificate of deposit account registry service the certificate of deposit account registry service cdars is a program that allows you to purchase cds at different banks providing up to 50 million of fdic coverage rather than the typical 250 000. If you deposit cash the funds are available for use the same day. The bank that takes in the deposit reinvests the money in multiple federally insured bank accounts with other banks.